How To Prepare A 1099 Form

Are you a business owner or self-employed individual who needs to report payments made to independent contractors or freelancers? If so, you'll need to prepare a 1099 form to accurately report these payments to the IRS. The 1099 form is used to report various types of income, including freelance income, interest, dividends, and more. In this article, we'll walk you through the process of preparing a 1099 form, including who needs to file, the different types of 1099 forms, and the steps involved in filling out and submitting the form.

Who Needs to File a 1099 Form?

If you are a business owner or a self-employed individual who has paid $600 or more to an independent contractor or freelancer during the tax year, you are required to file a 1099 form. Additionally, if you have paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, you are also required to file a 1099 form. Failing to file a 1099 form when required to do so can result in penalties from the IRS, so it's important to make sure you comply with the filing requirements.

What Are the Different Types of 1099 Forms?

There are several different types of 1099 forms, each corresponding to different types of income. Some of the most common types of 1099 forms include:

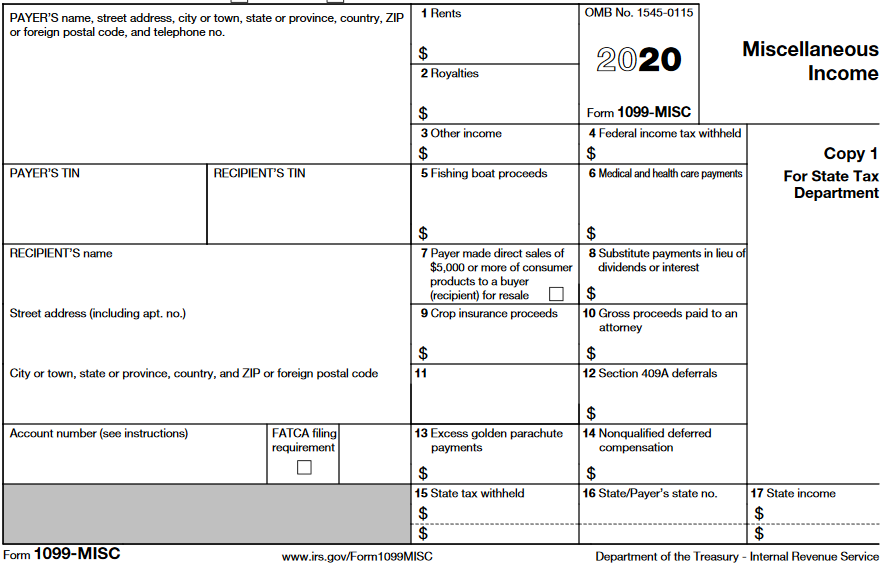

- 1099-MISC: Used to report payments made to independent contractors, freelancers, and other non-employees.

- 1099-INT: Used to report interest income of $10 or more.

- 1099-DIV: Used to report dividends and distributions of $10 or more.

How Do You Prepare a 1099 Form?

Preparing a 1099 form involves several steps, including gathering the necessary information, filling out the form accurately, and submitting it to the IRS and the recipient of the income. Here's a brief overview of the process:

- Gather the relevant information: You'll need to collect the recipient's name, address, and tax identification number, as well as the amount of income paid.

- Fill out the form: Once you have the necessary information, you can fill out the 1099 form, including your own information as the payer and the recipient's information.

- Submit the form: After filling out the form, you'll need to submit Copy A to the IRS, along with Form 1096, which summarizes the information on all the 1099 forms you are submitting. You'll also need to provide Copy B to the recipient of the income.

What Are the Penalties for Not Filing a 1099 Form?

Failure to file a 1099 form when required to do so can result in penalties from the IRS. The penalties vary depending on how late the form is filed and whether the failure to file was intentional. For example, if you file the 1099 form within 30 days of the due date, the penalty is $50 per form, with a maximum penalty of $187,500 for small businesses. However, if the failure to file was intentional, the penalty can be as high as $550 per form with no maximum penalty.

How Can You Avoid Penalties?

To avoid penalties for not filing a 1099 form, it's important to make sure you are aware of the filing requirements and to file the forms accurately and on time. This may involve keeping accurate records of payments made to independent contractors and freelancers throughout the year, as well as staying informed about any changes to the filing requirements.

Conclusion

Preparing a 1099 form is an important responsibility for business owners and self-employed individuals who have made payments to independent contractors and freelancers. By understanding the filing requirements, the different types of 1099 forms, and the steps involved in preparing and submitting the form, you can ensure that you comply with IRS regulations and avoid potential penalties. If you have any questions or need assistance with preparing a 1099 form, it's advisable to consult with a tax professional or accountant to ensure that you fulfill your reporting obligations accurately and on time.

1099 Printable Form

IRS Form 1099 Reporting for Small Business Owners

Your Ultimate Guide to 1099MISC